As many small to middle market companies and nonprofits grow, they are looking for financial accounting and ERP software to take them to the next level. These organizations frequently operate on QuickBooks, MS Dynamics, Blackbaud, or other locally installed applications.

As many small to middle market companies and nonprofits grow, they are looking for financial accounting and ERP software to take them to the next level. These organizations frequently operate on QuickBooks, MS Dynamics, Blackbaud, or other locally installed applications.

Organizations want to move to the cloud in a way which meets their requirements of today, but allows them to grow and expand their software functionality, and never go through another implementation again. To achieve this, organizations are looking at cloud based ERP/Financial Accounting applications. This article is unique in that it benchmarks some of the leading applications based upon real world experience and surveying organizations post selection and implementation.

SAGIN, LLC does not resell software and its professionals have performed over 155 independent software selections. Our process helps companies identify their requirements and select the software application which will best meet their needs and address the growth of the business.

When performing a software selection, it is important to note that a comprehensive list of requirements should be created and weighted, knowing that not one software application will meet all of your requirements. Through this approach, the selection is guided by those requirements which are more critical in supporting the business. Identifying the requirements is best achieved by mapping the current business processes and designing future state processes to incorporate best practices. If the organization is looking to make a transformational change, this will help them focus on the future as opposed to to staying with the status quo.

Many of our clients in the small to middle market sector, including both profit and nonprofit, are looking to shed their legacy system environments for a cloud solution. This opens the door of opportunity to more robust functionality and less maintenance. When performing these selections, we frequently see five leading contenders: Acumatica, Blackbaud (Financial Edge & Raisers Edge), Intacct, NetSuite and Workday. Clients have chosen different applications based upon their specific needs. This article will provide you with some high level benchmarking of key functionality and narrative insight on each application from users who have actually used the applications post selection and implementation.

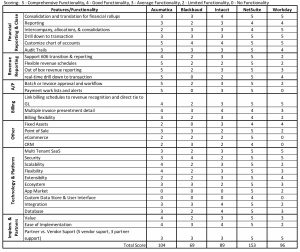

When evaluating software applications, it is important to perform scripted demos to your specific requirements and business processes. Having evaluated these application over the past three years, we benchmarked some key areas including: Financial Management, Revenue Reporting, Accounts Payable, Billing, Technology Platform, Implementation, and other integrated functionality including CRM, POS and eCommerce. The following table shows how these applications scored in their functionality:

Each application has its own strengths and weaknesses. Overall, we have found Oracle’s NetSuite to be the leading overall cloud based application for the small to middle market organization. Although other software applications could achieve the functionality and capabilities of NetSuite, NetSuite was the strongest fully integrated application with an easier implementation and strong value based pricing. For nonprofit organizations, NetSuite’s pricing was very competitive and their prepackaged implementation solution significantly lowered implementation costs. NetSuite fully integrates eCommerce, CRM and POS functionality which makes it very robust and a leader verse other software companies which require add-on applications, API’s and multiple implementation partners. NetSuite has also acquired Open Air which will incorporate project management, time and expense tracking as well.

The following are some key observations of each application which you will find useful in evaluating which software is right for your organization.

Acumatica

Many of you have never heard of Acumatica before, but that should not be of concern since Acumatica has been one of the fastest growing cloud ERP systems in the past three years. They have over 2,000 customers in 30 countries with the largest share in Scandinavia. Their strengths are in the Wholesale Distribution and Discrete Manufacturing sectors. Many of Acumatica’s leadership came from Microsoft so hence they are very successful in replacing MS Dynamics clients with their product. They were founded in 2008 and headquartered in Kirkland, WA. with approximately 140+ employees and 400+ Value Added Resellers (VARs). Some key observations include:

- They rely on VARS to deliver services and solutions which translates your experience to the quality of your VAR.

- They charge for their product by transactional volume not per user, so hence they appeal to small companies but will get very expensive if you grow.

- Strengths are in financial management, distribution/inventory, project accounting, field service, etc.

- eCommerce relies on an integration with Magento.

- All modules are separate functions that are not tightly integrated.

- Deploys a thick G/L and requires manual consolidation process of all subsidiaries by booking manual journal entries and eliminations.

- Direct support and development is located in Russia and billed in 15-minute intervals. This was not well known by clients until after implementation and in light of current events many clients have expressed concerns.

- Procure to pay is well integrated and automated.

- International functionality exists, but is a single database per instance/country.

- Revenue recognition is very robust with deferred revenue and scheduling.

Blackbaud

Primarily made popular in the Non-profit sector, Blackbaud is comprised of two applications, Financial Edge (G/L) and Raiser Edge (CRM). Total revenue is approximately $730M and relies heavily on maintenance and licensing rather than new sales and market growth. They have over 23 products with Financial Edge and Raiser Edge being their primary anchors. More than 6,000 nonprofits and governmental organizations use their product to manage accounting and CRM/fund raising. They were founded in 1981 and started with student billing. Since then the company has grown through acquisitions of smaller pointed solution providers. Blackbaud had a strong secure future in the Non-profit sector being the dominate provider. However, with the rapid growth of other cloud-based ERP applications and competitive pricing, customers are leaving. In addition, with free licensing to non-profits by Salesforce.com, nonprofits are dropping Raisers Edge. The following are some key observations:

- Raiser Edge (CRM) is not integrated with the G/L

- Reports and dashboards are rigid with limited configuration and flexibility.

- Application does not integrate well with MS Outlook or Google which is the primary email applications of most users.

- No inventory management and limited fixed asset tracking

- Strong fund accounting including NPO reports and grant management. Utilizes self-balancing fund accounting and journal entries are created automatically.

- Grant management is strong, allowing the user to allocate expenses across grants.

- Blackbaud is not a true cloud based solution. It is either client server or hosted by a third party and operates on a single tenant infrastructure.

- Users will need to have an application developer on staff or contract one to configure the product if any future changes are desired.

- Not strong with multi-currency requiring a separate database for each currency.

- Reporting is very cumbersome and weak. When users add an account, they will need to update every report using that new account. When exporting reports to Excel the rows do not line up. Custom reports rely upon using Crystal Reports.

Intacct

In July 2017 Sage Group Plc (Sage) acquired Intacct which was a privately held company based in San Jose, CA. Intacct revenue approximates $88M. Sage’s revenue growth was grinding to a halt over the past five years and hence liquidated some of their assets and acquired Intacct. Intacct has not invested in their international and localization which will hinder the company’s growth internationally. Intacct was primarily built to be an accounting application and is playing catch-up in trying to become a full ERP. The following are some key observations:

- Workflow functionality is poor. There are basic approvals, however they are not graphically represented and it requires administrator modification of records and permissions to effectively work.

- GL structure still requires the use of sub-ledgers for AP and AR which creates silos and if segments or dimensions are left out create reconciliation errors and is very inefficient.

- Intacct has many predefined financial reports; however, users cannot create reports with data from more than one module (e.g. GL, AR, AP, etc.)

- Multi-company consolidations are a manual process. “Due-to” and “Due-from” transactions have to be recorded in each entity. Therefore, drill down capability is a major challenge going from the consolidated entity to the subsidiary.

- Revenue recognition for subscription billing is only achieved through an add-on application and requires reconciliation between applications.

- Requires partners to implement the solution. Therefore, the implementation and support experience is only as good as the partner. Limited aftermarket support from the company.

- Relies heavily on batch processing of transactions which is an old approach.

- The company purchased an endorsement from the AICPA.

- Core technology reveals data mining challenges, separate databases and customizations which must be tested by the VAR before an upgrade. This is not consistent with current best practices in cloud computing.

- Past implementers have reported high use of Excel off-line to augment gaps in technology and reporting.

- Reliance on VAR creates higher long term operating costs.

- Eight (8) Standard GL segments and additional can be added at an increased cost.

- No preconfigured industry solutions.

- Past customers have expressed buyer’s remorse stating the product was masked to be integrated and easy to use, but post implementation lacked cross module integration and batch processing orientated. Many of these customers were migrating from QuickBooks.

- Intacct is very competitively priced; however, total future implementation cost and support may be substantial depending on the VAR. Our observations would strongly recommend performing a scripted demo to your business needs when evaluating this solution.

NetSuite

NetSuite was founded as a private company in 1998 and was one of the first on-line subscription based accounting software applications and pre-dated Salesforce.com. NetSuite became a public company in December 2007. NetSuite was acquired by Oracle in July 2016 to be the small to middle market full cloud based ERP software. Oracle operates NetSuite as a stand-a-lone company focused on its target market. Over the years the product expanded to a fully integrated ERP including CRM and eCommerce which is one of few in the industry where on-line sales is integrated directly into the ERP application. The company has approximately $800M in Revenue, over 5,000 employees and 30,000 organizations using their product. Some key observations include:

- All of NetSuite’s transactions impact the G/L directly which provide full drill down capability real-time to the source transaction.

- Workflows are customizable by the user without being constrained by any single module and doesn’t require the use of an application developer or VAR.

- NetSuite supports real-time continuous consolidations with no discrete consolidation process run at month-end.

- Revenue recognition is very robust allowing for deferred revenue, multiple revenue schedules, subscription billing and all within the core application, making it 606 compliant.

- Companies with global operations and multiple currencies will find that NetSuite operates in one single instance allowing multi-country and multi-currency subsidiaries along with automated country tax calculations for 100 countries. Translations are real-time and supports full drill-down capability. In addition, the application supports multiple languages.

- Implementations can be performed by partners or with NetSuite Services. Post support is available with NetSuite 24/7 365 days a year.

- Application operates on one common database otherwise known as a single cloud multi-tenant approach.

- G/L operates with 3 standard segments and additional segments can be added with no limit. Changes and G/L Extensions/Fields can be added by the user and do not require coding, developer or VAR.

- Customizations (NetSuite refers to them as personalization), does not require coding and changes are automatically migrated in future upgrades.

- Reporting is flexible which allows the user to create reports across the full database and modules.

- NetSuite is fully scalable and allows for unlimited subsidiaries (recent change).

- The company has specialized pre-configured instances by industry including a specialization with reduced pricing for Non-profits and implementation (“Suite Success”).

- Application is fully mobile and operates on any device from computer to tablet to phone.

- CRM is fully integrated and part of the Suite. This eliminated the need to interface CRM sales and lead generation into the G/L to record a sale. In addition, eliminates the need to capture current customers and contact them through the CRM application. Most Customers who have implemented NetSuite have abandoned their stand-a-lone CRM applications including Salesforce.com. This allows for one unified customer record.

- The application fully integrates with MS Outlook and Google email platforms.

- There is no version lock of the application. Upgrades are seamless and do not require a new project or VAR in the future.

- NetSuite offers a series of Apps similar to an App store which are fully approved and licensed to work with the NetSuite application and extends the functionality.

Workday

Workday was founded by former PeopleSoft and SAP executives in 2005. The application provides a cloud based solution for finance and human resources. Ideally, this application is designed for organizations which are services or have a heavy human capital component such as professional services, universities, etc. Similar to its founding parent, PeopleSoft, the application led with human capital management and progressively added talent management and employee benefits administration. The company went public in 2012. Workday Financials first hit the market in 2007. The company is strong in financial services, technology, business services, healthcare and life sciences. Although having clients in the manufacturing and supply chain industries, it is not their focus. Company revenue is approximately $1.5B. The product is significantly more expensive and the sales focus is on larger companies. They have few implementations but higher revenues than competitors in this space. Some key observations include:

- Product offering has some unique and industry specific modules including: Workday Financial, HCM, Planning, Student and Professional Service Automation.

- Implementation partners are large professional services firms including: Accenture, IBM, Aon Capgemini, CSC, HP, PwC, KPMG, etc.

- Revenue recognition is not flexible which doesn’t allow the user to create customized schedules making 606 compliance difficult.

- Not very strong on a global tax front only supporting a limited number of countries.

- Very strong Human Resource Management capability in a cloud based solution.

- Customer base is approximately 300+ installs but significantly focused on the $1B client.

- Statutory reporting is not available out of the box. Any additional reporting and localization is extra.

- HCM and Financials operate on one single database.

- Workday does not have any eCommerce capability and no plans to add this functionality.

- Their business process framework has pre-built workflows that the user can edit but not create.

- Strong employee performance reporting.

- The application uses “Worktags” which allow the user to create custom fields.

Overall, the best solution is one which not only fits your organization’s requirements but will adapt and grow with your needs over time. Many organizations have moved to Cloud based ERP products to eliminate the need to ever have to “upgrade” again.

When evaluating software applications, we recommend taking the following important steps:

- Map your current processes to determine your system requirements.

- Incorporate into your requirements future needs and best practices.

- Create scripted demos/case studies by which each vendor should follow in their software demonstrations. AVOID, allowing the vendor to give their own demo and sales presentation because they will only show you the best and it will not demonstrate how you conduct your business. This will also keep the vendor on task and provide comparability between the applications.

- Establish a cross-functional user base selection committee and have each one score the demo and participate in all demos. This is also the first step in the change management process by allowing key users to contribute to the selection and treat everyone equally.

- Schedule the software demonstrations back to back or as close in timing as possible. This allows the participants to remember the demos and have a stronger basis of comparability.

We hope this article helps provide some insight on key aspects in selecting and evaluation leading cloud based ERP software applications for the small to middle market.

SAGIN, LLC is a professional services firm providing Consulting, IT Services, Organizational Development, Recruiting and Risk Management. If you would like to learn more about the information in this article or these solutions, you can contact us at: +1.312.281.0290 or info@saginllc.com. Also visit us at www.saginllc.com